nys workers comp taxes

Generally the Internal Revenue Service IRS does not consider NY workers compensation benefits to be taxable income. The money you receive from Workers Compensation in New York State generally is not considered income to be taxed under federal state or local income tax codes.

Employer Compensation Expense Tax About New York State S New Payroll Tax

The IRS in Publication 907 specifically states that workers.

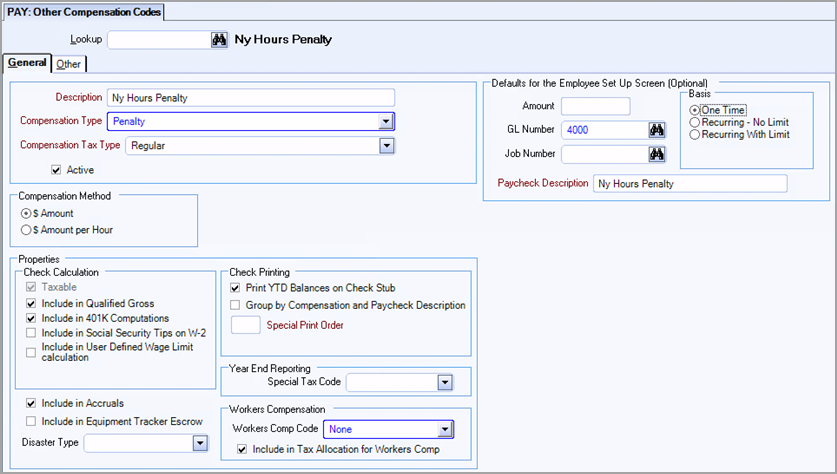

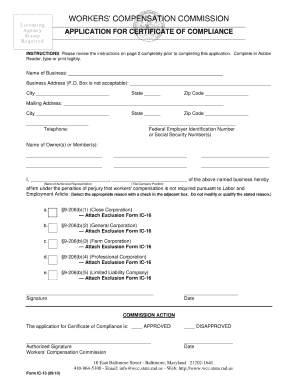

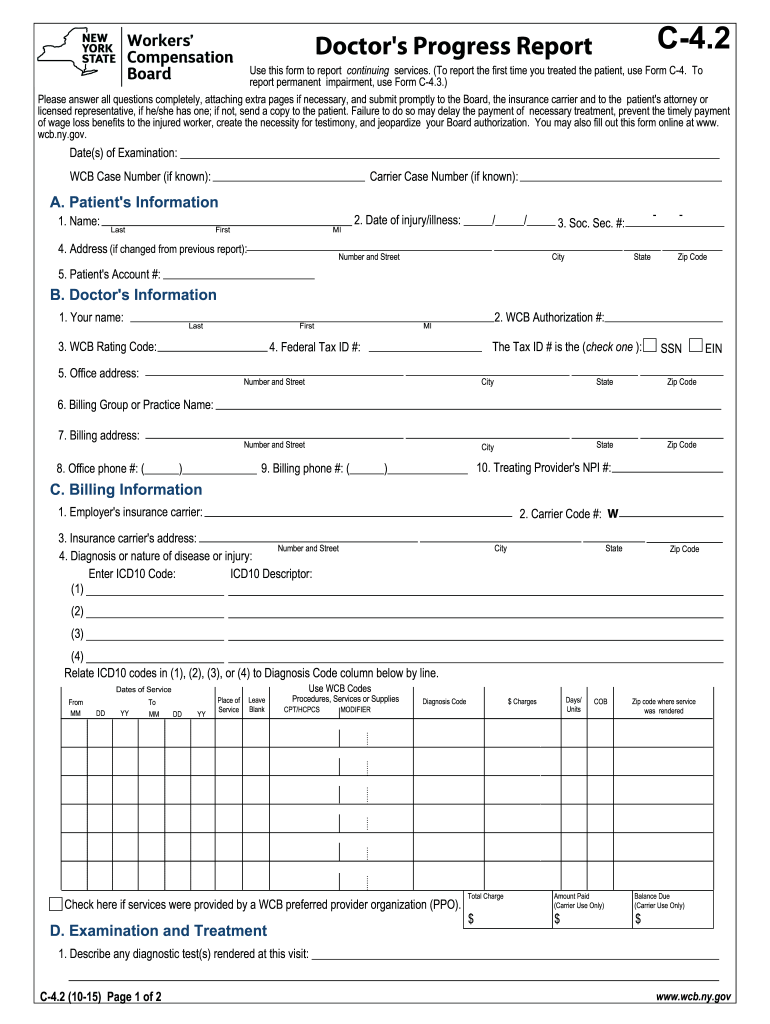

. Forms required to be filed along with instructions can be. NYS Workers Compensation Board. Employer Compensation Expense Program ECEP The Employer Compensation Expense Program ECEP established an optional Employer Compensation Expense Tax ECET that.

Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury. Ny state workers compensation rates nys workers comp rates 2020 nys workers compensation rate schedule nys workers compensation insurance rates new york workers compensation.

The Advocate for Business offers educational presentations on topics important to business such as an. If you earned 72000 or less in 2021 use NYC Free Tax Prep to file for free and keep your whole refund. Employers may also be required to.

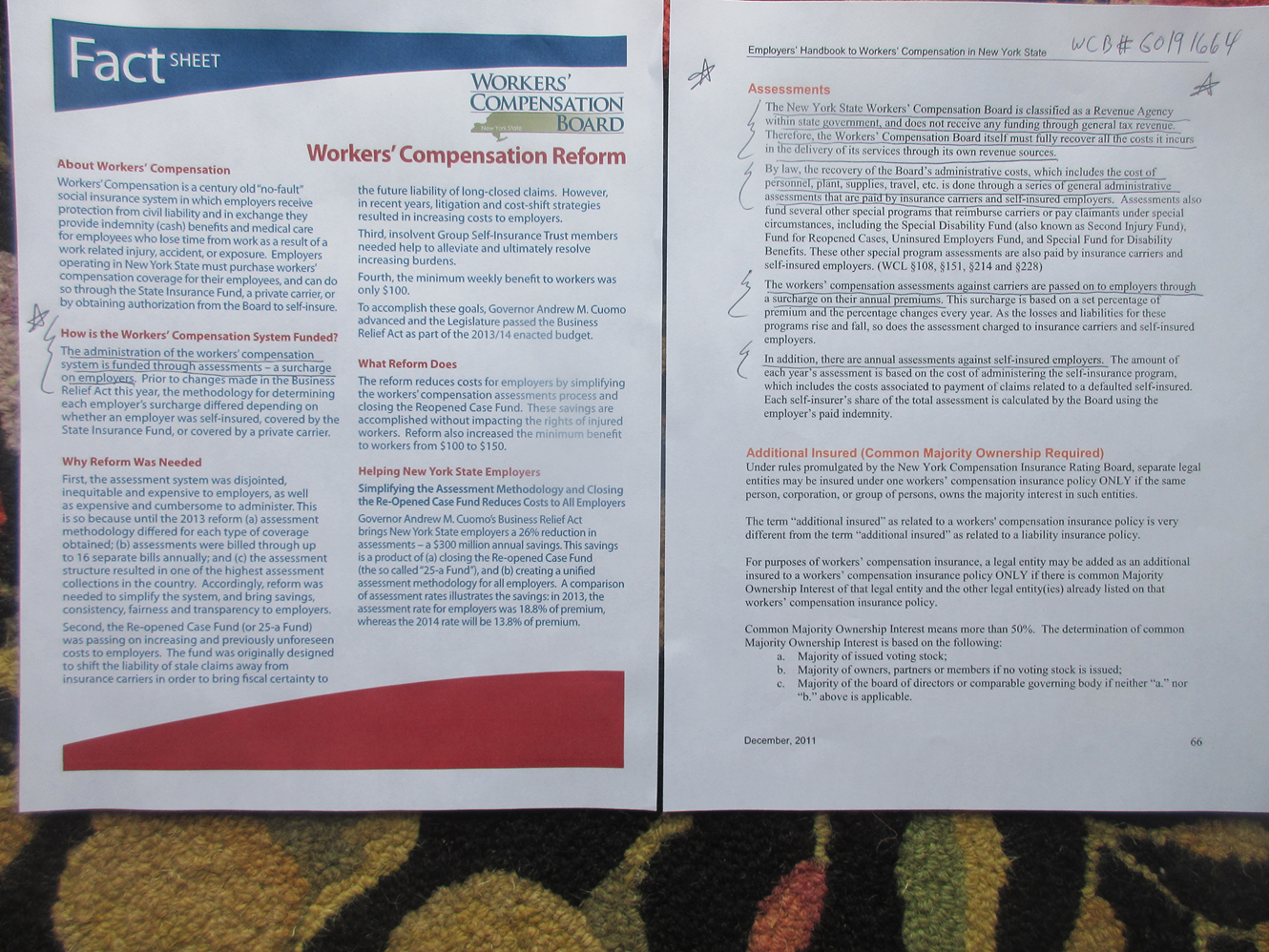

If you withhold New York State New York City or Yonkers income tax from your employees wages you must report it quarterly on Form NYS-45. Since 1914 NYSIF has guaranteed. The Workers Compensation Board is a state agency that processes the claims.

The tax rate on life premiums is 7. Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of. In New York state law requires employers to cover all employees with workers compensation and disability insurance.

The quick answer is that generally workers compensation benefits are not taxable. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS. Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors.

The tax liability as computed may not be less than 15 or more than 2 of taxable premiums. Information for Employers regarding Workers Compensation Coverage. Overview When the Workers.

Filing requirements NYS-45 NYS-1 Filing methods. Also under IRS regulations non-taxable workers. You are responsible to pay.

NY Rates are about 155 higher than the national median. The workers compensation system in. Failure to comply with state workers compensation insurance rules can.

NYC Free Tax Prep. It protects employers from liability for on-the-job injury or illness and provides the following. Workers compensation insurance is mandatory for most employers of one or more employees.

If Board intervention is necessary it will determine whether that insurer will reimburse for cash benefits. NYSIF has announced that for the first time in its 108-year history it will extend coverage to policyholders out-of-state employees. Workers Comp Exemptions in New York.

Is Workers Comp Taxable Workers Comp Taxes

20 Printable Nys Workers Compensation Exemption Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Workers Compensation Lawyer Nyc The Platta Law Firm

![]()

New York Nanny Tax Rules Poppins Payroll Poppins Payroll

New York Paycheck Calculator Smartasset

Employers Fund The Nys Workers Compensation System Ny Fbi So To A Reasonable Person This Sounds By Timgolden Medium

Out Of State Remote Work Creates Tax Headaches For Employers

Workers Comp 101 Do Employers Have To Pay For Workers Compensation

Bronsky And Co Offer Resources To Make Taxes Easier Upstate Ny

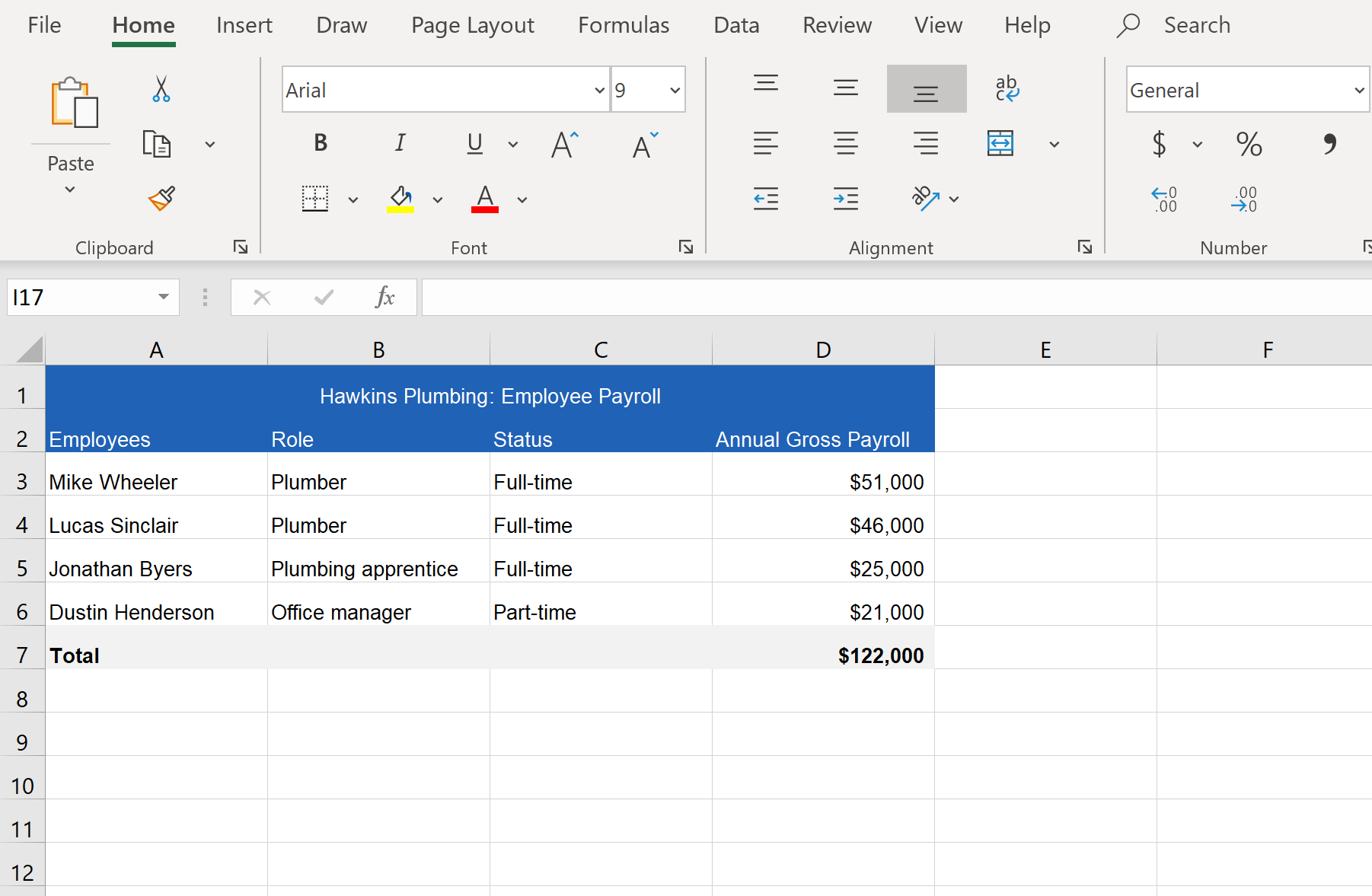

Workers Compensation Payroll Calculation How To Get It Right

The Ultimate Guide To Workers Compensation Laws In New York

C4 Form Fill Out Sign Online Dochub

New York Budget Gap Options For Addressing New York Revenue Shortfall

Time For A Real Look At How The New York State Workers Compensation System Treats Workers Center For New York City Affairs

New York Hourly Paycheck Calculator Gusto

Nys Workers Compensation Court Decisions

Workers Compensation Insurance In New York Cerity

Springville Ny Worker S Compensation Insurance Policies Haddad